National Insurance Rates - Rates Thresholds 2020 21 Brightpay Documentation

We also make the process extremely easy by utilizing technology to compare the benefits and costs of different final expense life insurance provider rates. One of a suite of free online calculators provided by the team at iCalculator.

2019 20 Tax Rates And Allowances Boox

You paid 2 on any earnings above 50000.

National insurance rates. If you earn less than this amount youll pay no National Insurance contributions. Sickness and Maternity Benefit Rates. The rates for most people for the 2021 to 2022 tax year are.

Find out more about National Insurance on our accounting glossary. At Compare National we only work with the top rated life insurance carriers in the country that have plans that never expire increase in premium or decrease in benefit amounts. National Insurance rates 2020-21.

If you earned more you paid 12 of your earnings between 9500 and 5000. BORIS JOHNSON has confirmed the news that National Insurance will be increased to 125 percent from April 2022 to pay for the social care crisis. All quotes are subject to the terms and conditions set forth on the generated quote.

Find out more about National Insurance on our accounting glossary. The figures shown indicate what youd owe on an annual. Alternatively to find out how your bill is calculated see our guide to National Insurance rates.

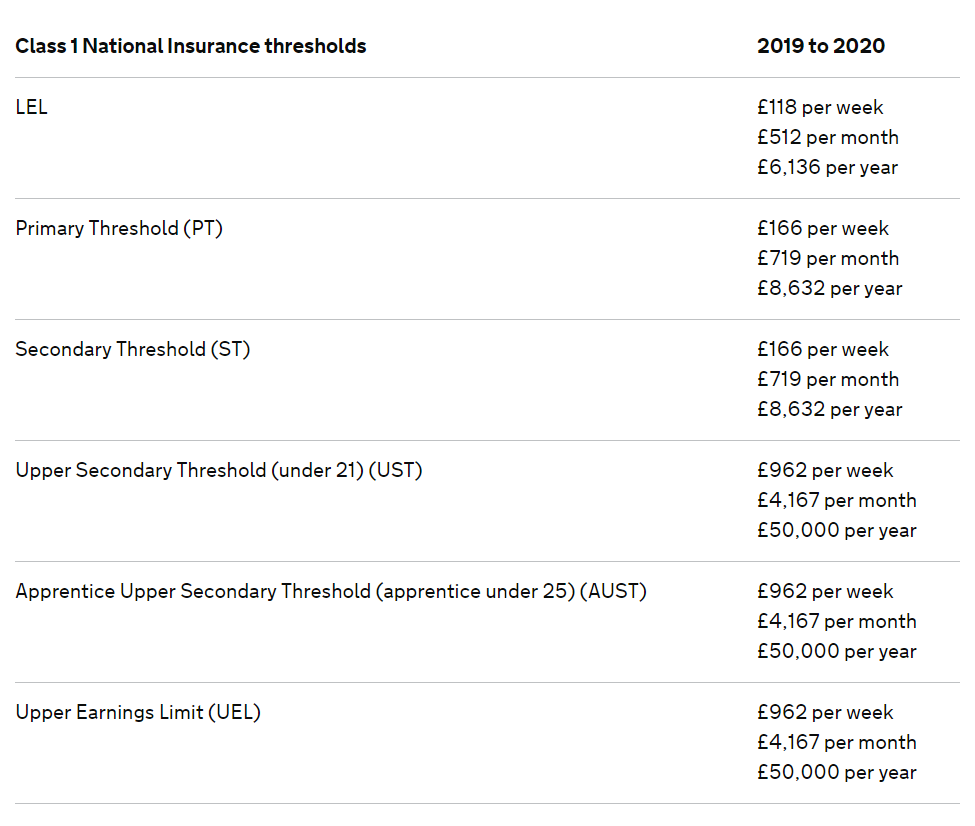

Retirement and Invalidity Pension Rates. Your pay Class 1 National Insurance rate. Earning 118 to 166 a week 512 to 719 a month Earning 16601 to 962 a week 71901 to 4167 a month Earning over 962 a week More than 4167 a month A.

National Insurance is money paid to HMRC by employees employers and the self-employed. You pay Class 1 National Insurance contributions. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

The National Rate Calculator NRC is a web-based platform designed to help our customers and agents estimate the potential settlement-related costs for a residential real estate transaction. Employers National Insurance is a type of Class 1 National Insurance that employers have to pay to HMRC in respect of their employees wages. Rates of Constant Care and Attendance Allowance for persons qualifying on or after March 4 2013.

National Insurance rates bands thresholds and classes explained By Harry Brennan 6 September 2021 1211pm Since 1911 workers have paid National Insurance. Survivors Pension Rates Weekly and Monthly Benefit. It is at this point that.

Calculate Employers National Insurance Contributions in 2021 for one or multiple employees up to 50 for individual employer NI and total Employers NI costs for 2021 forecast for 2022 and historical employer NI Rates. National Insurance rates and earnings limits 2018-19 you do not need to look at this table if you are using the NI tables Lower Earnings Limit Primary Threshold PT Secondary Threshold Upper Earnings Limit Upper Secondary Threshold UST Apprentice Upper Secondary Threshold LEL Weekly 2 weekly 4 weekly Monthly Annua Contribution. Use the Tax year dropdown to see how much youll get from 6 April 2021.

184 to 967 a week 797 to 4189 a. From April 2023 the levy will appear as a separate entry on individuals pay slips. Rates of Medical Expenses - Effective March 4 2013.

The lower national insurance contribution rate for fishing hunting and childminding in own home is linked to the the fact that these industries pay a product tax which is partly intended to cover the difference between 82 and 114 national insurance contributions. Paying Class 1 employees National Insurance contributions entitles you to receive certain state benefits. By accessing the National.

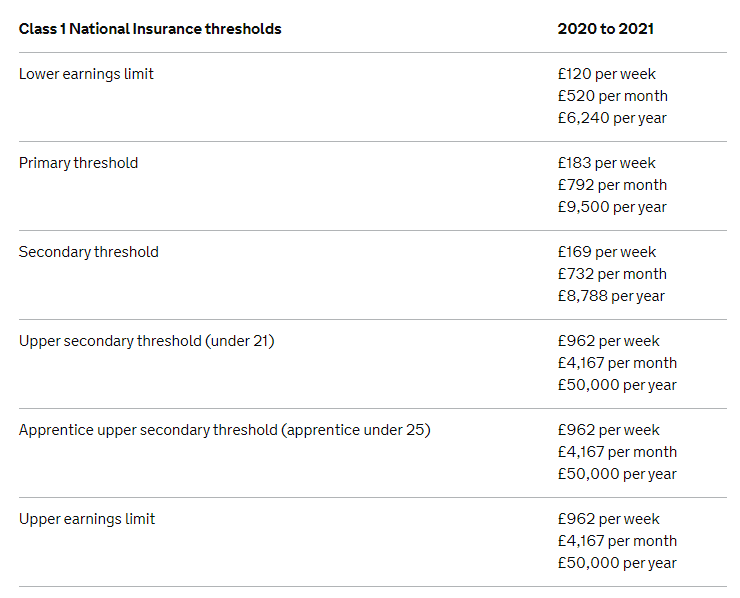

Between 2022 and 2023 National Insurance rates will rise by 125 percentage points. For 2020-21 the Class 1 National Insurance threshold was 9500 a year. This calculator has been updated for the 2021-22 tax year.

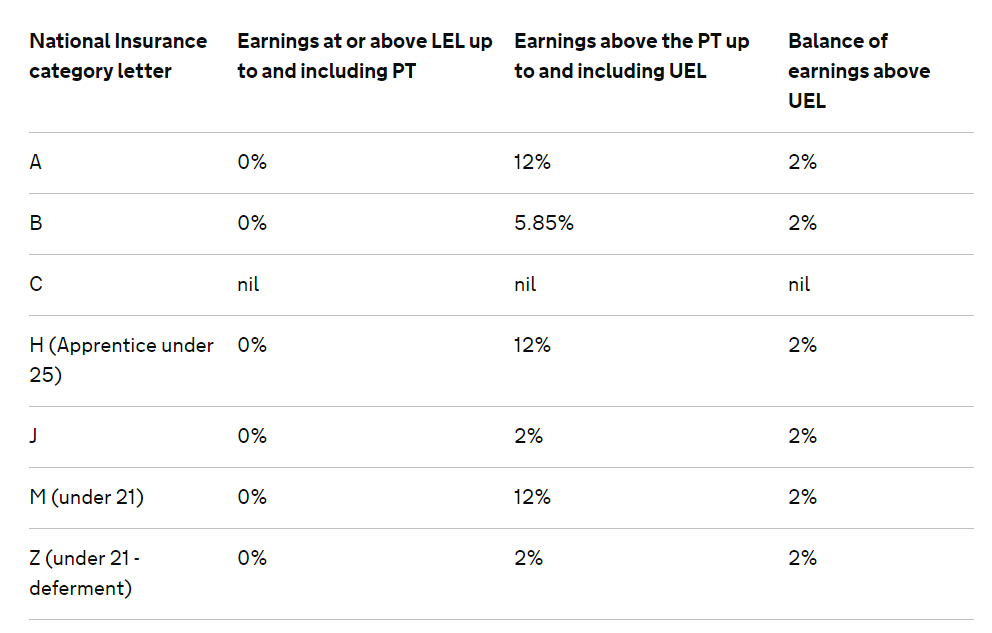

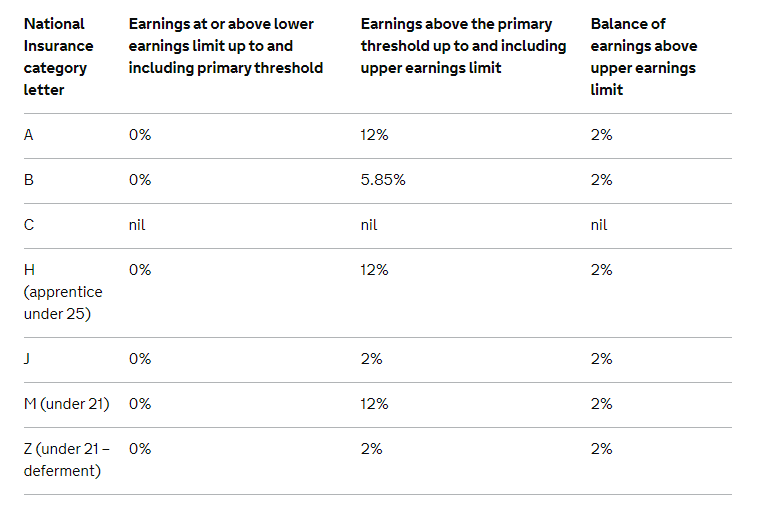

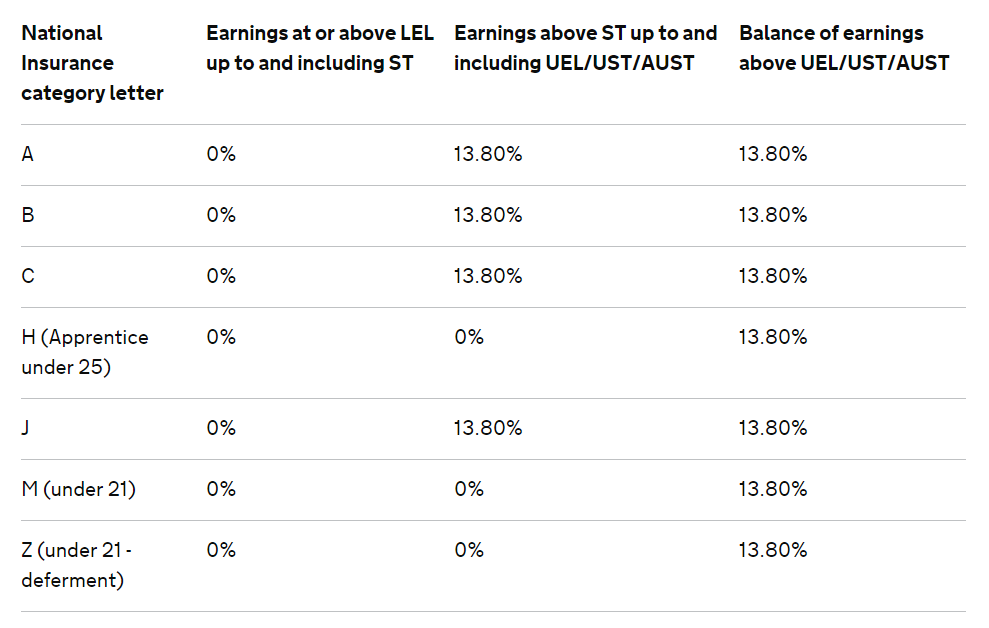

The National Insurance table shows the rate that employers deduct from their employees pay for the tax year 2021 to 2022. For full details of how employers should pay towards all employees National Insurance including rebates and special rates check. National Insurance rates and thresholds for 202122 202021 201920 201819 201718.

National Insurance Contributions Explained Ifs Taxlab

Rates Thresholds 2019 20 Brightpay Documentation

National Insurance Contribution Changes 2021 2022 Payadvice Uk

Shows The Retention Rates Of The National Insurance Company For The Download Scientific Diagram

Self Employed National Insurance Contribution Rates 2021 22 Ifs Taxlab

Class 1 Employee And Employer National Insurance Contribution Rates 2021 22 Ifs Taxlab

National Insurance Contributions Pw Accountants Ltd

Software Update April 2016 National Insurance Iris Kashflow

File Uk Income Tax And National Insurance Charges 2016 17 Png Wikimedia Commons

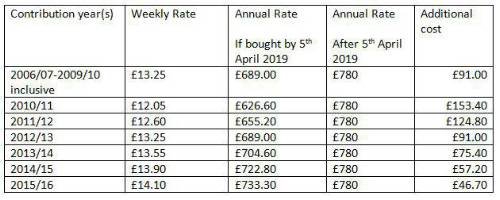

Workers Urged To Top Up State Pension Now To Avoid Cost Rise

Rates Thresholds 2020 21 Brightpay Documentation

National Insurance Rates 2019 20 Surya Co Accountants

National Insurance Contributions Complete Guide And Faq

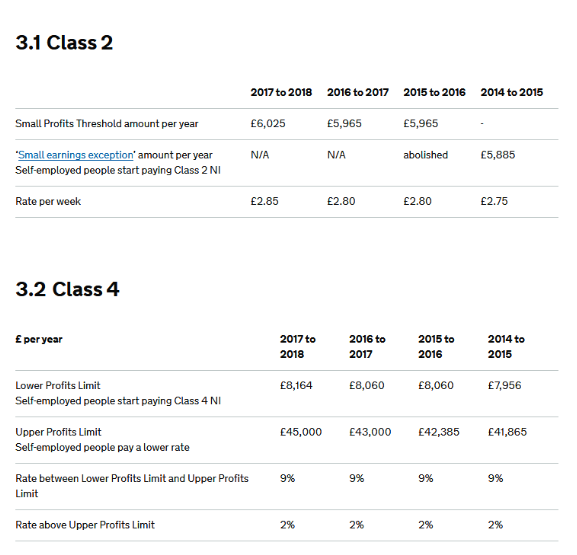

Self Employed National Insurance Rates

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2019 20 Brightpay Documentation

Class 1 Employee S National Insurance Rates 2021 22 Freeagent

Do You Have A Gap In Your National Insurance Record

What Is The Difference Between Class1 And Class 1a National Insurance

Posting Komentar

Posting Komentar